One Platform For Every Payment

Payment admin is an important topic but one that can often go under the radar for businesses. While your finance team will be delighted with a super-efficient accounts payable process, there’s few opportunities to shout about it.

But ignoring the issue is a mistake as your old process could have inbuilt inefficiencies and security vulnerabilities that need to be considered.

Payments can often be one of the biggest drains on time, and because there’s a limited amount of ways to improve them, they tend to get less attention than more high-profile tasks.

In this piece, we are looking at why many businesses are rethinking their payment processes and moving away from the piecemeal approach, to a more cohesive solution.

To understand what has happened in the payments industry over the last few years we have to consider the evolution of payments.

Twenty years ago if you wanted a solution then you went for installed software. Typically you would buy the software, pay a specialist to implement it and integrate it with your other systems (if that was possible) and provide training for your people.

It was expensive, time-consuming and took a lot of effort. But because of this, there was tremendous pressure to get it right and make sure it worked for the whole business.

But the world changed with the advent of cloud-based SaaS (Software as a Service) systems.

The convenience of both implementation and ease of use meant that the rise of cloud-based services was positively meteoric.

SaaS systems also proved incredibly attractive because they allowed companies to adopt solutions quickly, with little or no need to employ a specialist or go through a huge implementation project.

Whilst many SaaS products were just emulations of what locally installed software used to do, very quickly, other solutions appeared that focused on only a part of a process.

So-called best-in-breed apps appeared that would do a bit of a process but had great integration so it was possible to quickly patch several of these together to do what the old installed software used to do.

They were cheap, quick to implement and quick to learn so they took off very quickly.

But today we’ve seen the issue with having multiple solutions to prop up one single process – though they often integrate, issues arise that weren’t present with a full-service end-to-end solution. Many companies have ended up in a situation where they have a huge number of different apps, some of which do very similar things, all sitting in a rather convoluted ecosystem.

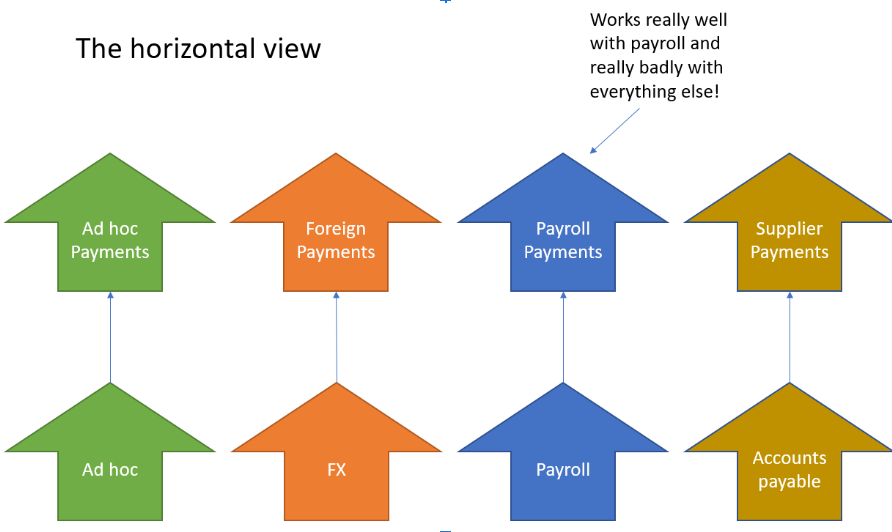

For example, we see companies that will pay their suppliers through accounts payable using one platform, overseas payments using another, payroll on a different app and one-off payments usually manually through their bank account.

There’s a conceit in the title ‘best-in-breed’ in that it assumes that each app patched together is as efficient as they are separately.

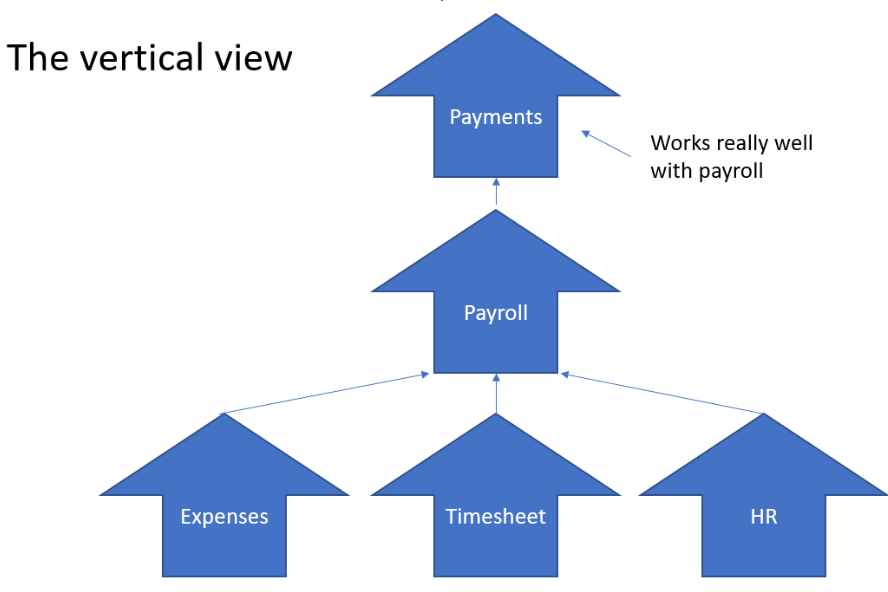

If you look at them vertically then this could well be true but when you look at a function horizontally we see a different picture.

So what do we mean by vertically and horizontally?

When you think of a process end to end then it seems to make sense to have the best app at every stage of the process. The best timesheet app, the best payroll app, the best payment app. In other words a vertical process.

Each app is integrated so that theoretically they do the best job possible for the company and the employees. When you look at the vertical view image below, you’ll see why that seems so sensible.

However, in practice, this may look somewhat differently. By evaluating how payments are integrated in each function, you may find inconsistencies in how the solution is applied.

So while the payments function may have been selected for its integration with for example payroll, we must also evaluate how well it integrates with all other payment functions.

Having a different app in each process means that there are three or four different systems to learn, three or four different support sources and three or four compliance routes to go down.

In other words, in an effort to slim down and make things more efficient for payroll, some business managers have inadvertently made things more complicated.

This is a natural result of the way we buy our systems. We set out on a project to make our payroll system better or our accounts payable process better.

This means we focus on payroll or accounts payable in a vertical manner, but without assessing what this decision means for all of the other processes that use the same type of system we risk making the system more complex, rather than less.

To get the best possible outcome for the company as a whole we need to assess systems holistically.

It’s easy to become so enamoured of buying single apps and then patching them together that we forget the primary objective; to make the company more efficient.

To combat this, we need to look not only at the vertical process but also the horizontal effect, every time we are looking to implement a new system or software.

What other systems does our change impact? Is integrating payroll with one payment system and AP with another really the best way to go?

From the point of view of your finance people, there is one key benefit of a single payment solution - they only need to learn one!

Don’t dismiss the cost of learning when it comes to systems. It takes a while, even if you have the most user-friendly system out there.

If you are not careful you end up with either four different system experts or one person that knows a bit about each solution.

In the case of the four experts what you have introduced into the process is risk. A risk that one of your people will go off sick or leave and the others won’t know how to use the system effectively.

In the case of the single person, you have someone who knows a bit about each system, meaning that they never quite get the most out of the functionality of each because they are so busy trying to remember four different ways to log on or input payments.

You will also likely see a human effect that happens when we have multiple systems – the snowball effect of minor mistakes.

If you have four systems to log into, a lot of people will do one of two things; you either use the same password across all of your apps or you write each of your passwords down on little yellow notes that you then stick to the side of your monitor. Not especially secure.

If something goes wrong with the horizontal system you have a subject matter expert in-house and available to work on the issue and you also have a single support path to go down.

Cost is also an issue. Single-issue apps may look cheap in isolation, but multiply that by the number of different apps you are using to do the same thing and you can see that it doesn’t make financial sense.

When it comes to reporting and reconciliation the simple question is which is easier, reporting from one system or four?

The main barrier to implementing an all-in-one system tends to be the time and effort it takes to get it off the ground. Implementation tends to be more complex since you need to consider its impact across the whole business, rather than within one single function. But as you will notice, taking the time to implement efficiently will save you much more time and money across the lifetime of the system, so it is worth doing well from the start.

The poor people in the compliance department do get a hard time.

Whilst the rest of the business just wants to get on with its work, compliance has a really difficult job to do.

They have to make sure that every system is safe, secure and complies with whatever standards your company has adopted.

This means that they may need to produce system documentation and compliance reports for ISO9001 for customer service, ISO27001 for data protection or ISO 31000 for risk.

Four systems mean four lots of reports, four lots of assessments and four lots of headaches.

It also means four different apps to monitor for changes.

Individual apps are great at doing what they do and they can achieve great things for a business, but you need to be a little careful about the way you buy them.

Buying a single app in isolation can seem like the smart move when viewed in isolation, but when you start to look horizontally at the bigger picture you can see that what works well for one process doesn’t necessarily do the job for another.

For the sake of efficiency, cost and compliance an all-in-one solution wins every time.

And if you’re looking for a modern payment solution that will integrate well with all of your systems and give you a safe, secure and efficient way to pay people, give us a all today for a no-obligation chat about how our single-platform payment service can integrate with your systems and help you automate your payments.

Caxton Payments is an alternative to traditional banks, established over 20 years, we help businesses make faster payments more reliably. We offer streamlined processes, automation through API and a collaborative solution to complex payment issues all from a single platform. Our payment capability extends from business expense management, to payroll payments, supplier payments, and currency risk management. We also offer personal prepaid travel cards and international money transfer.

Senior Business Development Executive at Caxton. Specialising in International Payments, Foreign Exchange, and API Integration.

BOMCAS Edmonton Personal Tax Accountants: Navigating Your...

BOMCAS Canada: Navigating the Financial Landscape

Would you like to promote an article ?

Post articles and opinions on Ireland Professionals

to attract new clients and referrals. Feature in newsletters.

Join for free today and upload your articles for new contacts to read and enquire further.